Introduction

Wondering how to become a prop trader and turn your market insights into real profits—without risking your own money? That’s the power of proprietary trading. In this comprehensive guide, you’ll discover the step-by-step process to become a prop trader, from mastering the fundamentals to landing your first funded account. Whether you’re a market enthusiast or an experienced trader eyeing new horizons, you’ll find the roadmap to success here. Ready to transform your trading passion into a potential career? You’re about to uncover the thrilling world of prop trading and learn how to make your mark in this dynamic field.

Table of contents

What is a Prop Trader?

A prop trader, short for proprietary trader, trades financial markets using a firm’s funded account rather than their own. This type of trading is one where traders access funded accounts after proving their skills.

Prop traders typically trade various asset classes, including stocks, futures, foreign exchange, and commodities. They use advanced trading platforms and rely on technical analysis, market sentiment, and sometimes fundamental analysis to make trading decisions.

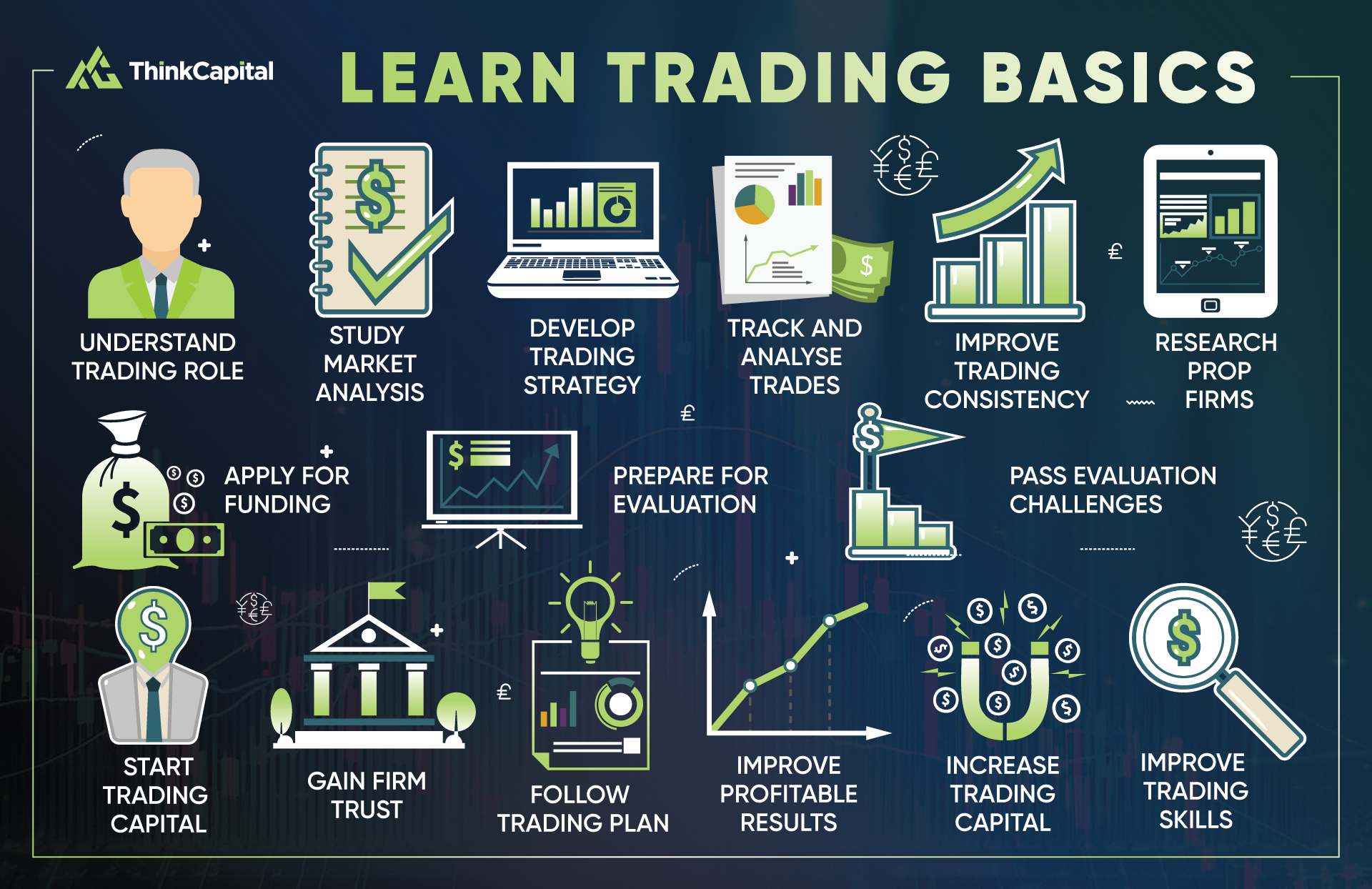

How to Become a Prop Trader

Becoming a prop trader requires dedication, skill, and a solid understanding of financial markets. Here’s a detailed step-by-step guide on how to become a prop trader:

1. Learn to Trade the Market

First things first, you need to understand how financial markets work. This involves learning about different asset classes like stocks, futures, forex, and commodities. You’ll also need to grasp market dynamics and price action, as well as study technical analysis and chart patterns. Familiarizing yourself with fundamental analysis is crucial, too. Lastly, it’s important to keep up with economic news and understand its impact on markets. All these elements work together to give you a comprehensive understanding of how financial markets operate.

2. Follow the Rules

Prop trading firms have strict rules to manage risk. Learning to follow these rules is crucial for your success as a prop trader. Some common rules include maximum daily loss limits and maximum drawdown limits. Position size restrictions are also typically enforced to discourage reckless trading or gambling behavior. These regulations work together to create a framework for responsible trading and risk management within the firm.

3. Set Up a Trading Strategy

Develop a trading strategy that works for you. This might involve day trading, where you open and close positions within a single trading day. Alternatively, you could consider swing trading, which involves holding positions for several days to weeks. Scalping is another option, where you make numerous trades to profit from small price changes. You might also explore trend following, which focuses on identifying and trading with the overall market trend. The key is to find an approach that fits your personality, risk tolerance, and lifestyle. Each strategy has its own advantages and challenges, so it’s important to choose one that aligns with your goals and trading style.

4. Practice Money and Risk Management

Risk management is perhaps the most important skill for any trader. Learn to use stop losses effectively to limit potential losses on trades. Managing your position sizes is also crucial to avoid overexposure to any single trade. It’s important to calculate and adhere to proper risk-reward ratios, ensuring that potential profits justify the risks taken. Additionally, diversifying your trades across different assets or strategies can help spread risk and potentially improve overall returns. By combining these techniques, you can protect your capital and maximize your trading potential.

5. Practice with Paper Trading

Before risking real money, use a trading simulation or “paper trading” account to practice your strategies. This approach lets you test your trading ideas in real market conditions, gain experience without the stress of potential losses, refine your strategy and risk management skills, and build confidence in your trading abilities.

6. Subscribe to a Prop Trading Program

When you’re confident in your skills, it’s time to look for a prop trading firm like ThinkCapital to start your journey. ThinkCapital’s program offers:

- Skill Evaluation: Test your trading abilities through their assessment process.

- Learning Resources: Access a wealth of educational materials.

- Professional Tools: Use ThinkCapital’s advanced trading platforms, designed for serious traders.

- Account Growth: As you prove your profitability, you can trade with larger account sizes.

ThinkCapital provides a straightforward path for aspiring prop traders. Their program helps you develop from a skilled trader into a professional prop trader.

While other firms offer similar opportunities, ThinkCapital’s combination of fair evaluation, strong support, and room for growth makes it a solid choice for those serious about prop trading.

7. Get Funded and Start Trading

After passing the firm’s evaluation process, you’ll be given a funded account to trade with. This is where the real journey begins! Remember to stick to your proven strategy, as consistency is key in the trading world. Manage your risk carefully, always keeping in mind the lessons you’ve learned about protecting your capital. Keep learning and adapting to market conditions, as markets are dynamic and constantly evolving. Maintain open communication with your prop firm, as they can provide valuable support and guidance throughout your trading career. These principles will help you navigate the challenges of live trading and increase your chances of long-term success as a prop trader.

8. Develop Essential Technical Skills

To succeed as a prop trader, you’ll need to master specific technical skills. Start by familiarizing yourself with popular trading platforms like Platform 4/5 or ThinkTrader, as this knowledge will form the foundation of your daily trading activities. Next, learn to use advanced charting software like TradingView to enhance your ability to analyze market trends and patterns. Understanding different order types and how to execute them efficiently is crucial for implementing your trading strategies effectively. By combining these technical skills, you’ll have a well-rounded toolkit to support your trading career.

9. Cultivate the Right Trading Psychology

Successful prop trading isn’t just about strategy—it’s also about mindset. Learn to manage fear and greed, which can lead to impulsive decisions, by developing strong emotional control. This skill is closely tied to discipline, which involves sticking to your trading plan and risk management rules, even during losing streaks. Patience is equally important; avoid overtrading and instead wait for high-probability setups. As you face inevitable setbacks, cultivate resilience—the ability to bounce back from losses and learn from mistakes. Throughout your journey, maintain a commitment to continuous improvement by adopting a growth mindset and always being open to learning. These psychological skills are interconnected and crucial for long-term success in prop trading. To further develop these mental abilities, consider reading trading psychology books or working with a trading coach.

10. Transition from Paper Trading to Live Trading

Moving from simulation to real trading can be challenging, but ThinkCapital offers a structured path to ease this transition. Begin with our free trial account to experience real market emotions without financial risk. This step is crucial as the psychological impact of trading can be significant. Next, progress to our trading challenge, where you can prove your skills and potentially earn a funded account. As you advance, gradually increase your position sizes to adapt to larger trades without overwhelming yourself. Maintain the strategy that worked in paper trading, as consistency is vital during this period. Keep a detailed trading journal to track your progress, emotions, and decision-making patterns. This self-reflection will be invaluable for your growth. Remember, initial setbacks are normal; focus on adhering to your plan and learning from each trade. With ThinkCapital’s support and resources, you’ll be well-equipped to navigate this critical phase in your trading journey.

Things to Know Before Becoming a Prop Trader

Now that you’ve learned how to become a prop trader, there are several important aspects of prop trading you should understand:

1. Costs and Taxes

As a prop trader, you’ll need to consider various financial aspects of your trading career. Platform fees and data subscriptions are essential expenses that provide you with the tools necessary for effective trading. At ThinkCapital, prop traders enjoy free access to essential tools like TradingView for charting and Traders Gym for backtesting strategies. By eliminating platform fees and data subscription costs, we provide you with the necessary resources for effective trading while maximizing your profit potential. This makes ThinkCapital an ideal choice for your prop trading career.

Additionally, you may encounter evaluation or subscription fees for prop firms, which are often required to gain access to their funding and resources. It’s crucial to be aware of potential tax implications, and consulting with a tax professional is advisable to ensure compliance and optimize your financial situation. Lastly, factor in costs for trading education and tools, as ongoing learning and access to quality resources are vital for your growth and success in the competitive world of prop trading.

2. How Prop Traders Make Money

Prop traders typically earn through profit-sharing arrangements with their firms. The exact split can vary, but it’s common for traders to keep 60-80% of their profits. Some firms also offer performance-based scaling plans, allowing successful traders to increase their account sizes and potential earnings. Here, at ThinkCapital, you can earn up to 90% of the profits.

3. Capital Requirements

One of the advantages of prop trading is that you don’t need a large amount of capital to start. Many firms require only a small fee to take their evaluation, after which you can earn access to a funded account.

4. Average Earnings of a Prop Trader

There’s no fixed salary in prop trading – your earnings depend entirely on your trading performance. Some traders make little to nothing, while successful traders can earn substantial amounts. It’s not uncommon for top performers to make six or even seven-figure incomes, but this level of success is rare and requires exceptional skill and consistency. Let’s crunch some numbers: Imagine you’ve got ThinkCapital’s allocation of a $300K funded account. With savvy trades, you nail a 10% return. That’s $30K in profits. Now, factor in our competitive 90% profit split, and you’re looking at a cool $27K in your pocket.

5. Daily Routine of a Prop Trader

A typical day for a prop trader might include several key activities. The day often begins with pre-market preparation, which involves market analysis and reviewing the latest news. During market hours, the focus shifts to active trading. Throughout the day, managing positions and monitoring risk are crucial tasks. After the market closes, a post-market review and strategy adjustment help to refine trading approaches. Continuous learning and skill improvement are also integral parts of the routine. Many traders start their day early to prepare for the market and may work long hours during busy trading periods, ensuring they stay ahead in the fast-paced trading environment.

6. Choosing the Right Prop Trading Firm

When selecting a prop trading firm, it’s crucial to choose one that aligns with your goals and trading style. ThinkCapital excels in key areas that matter most to traders:

- Stellar Reputation: ThinkCapital has built a strong track record, with positive reviews from both current and former traders. Additionally, ThinkCapital is backed by ThinkMarkets, one of the largest retail brokers in the world. This partnership adds an extra layer of credibility and stability to ThinkCapital’s operations, ensuring traders can feel confident in the platform’s resources and support.

- Innovative Funding Model: ThinkCapital offers a clear path for capital allocation and scaling opportunities for successful traders.

- Competitive Profit Split: Enjoy attractive profit-sharing arrangements that reward your trading success. At ThinkCapital, you can earn up to 90% of the profit.

- Comprehensive Support: You can benefit from ThinkCapital’s robust support and ongoing mentorship to enhance your skills.

- Cutting-Edge Technology: Trade confidently with ThinkCapital’s robust and reliable trading infrastructure. At ThinkCapital, you can trade directly from your TradingView charts, reducing the time from analysis to execution.

- Diverse Market Access: Explore a wide range of markets and instruments to diversify your trading strategies.

- Prudent Risk Management: ThinkCapital’s risk policies are designed to protect both the firm and its traders, promoting sustainable trading practices.

By choosing ThinkCapital, you’re partnering with a firm that prioritizes your growth and success as a prop trader. Our comprehensive approach covers all aspects of prop trading, from initial funding to long-term career development.

Remember to review ThinkCapital’s program details here. This due diligence will ensure you’re making an informed decision that aligns with your trading aspirations.

For a deep dive into why ThinkCapital is the best prop firm for you, read our article on Prop Trading Riches Unlocked with ThinkCapital.

Preguntas Frecuentes:

Q: What’s the difference between prop trading and retail trading?

A: Prop traders use a firm’s funded account and often have access to larger account sizes, while retail traders use their own money. Prop traders also typically have access to better tools and resources.

Q: Do I need a degree to become a prop trader?

A: While a degree in finance or a related field can be helpful, it’s not always necessary. Many successful prop traders come from diverse backgrounds.

Q: How long does it take to become a profitable prop trader?

A: This varies greatly depending on the individual. Some traders may see consistent profits within a few months, while others may take years to develop the necessary skills.

Q: Can I prop trade part-time?

A: While some prop firms allow part-time trading, most successful prop traders dedicate full-time hours to their craft.

Q: What are the most important skills for a prop trader?

A: Key skills include discipline, risk management, analytical thinking, emotional control, and adaptability to changing market conditions.

Q: How can I continue improving my trading skills?

A: Consider these resources for ongoing learning:

– Books: “Trading in the Zone” by Mark Douglas, “Reminiscences of a Stock Operator” by Edwin Lefèvre

– Online Courses: Platforms like Udemy and Coursera offer trading courses.

– Trading Forums: Participate in communities like EliteTrader or Forex Factory.

– Mentorship: Mentorship programs have been found to be very helpful for many traders.

Q: What are some common mistakes new prop traders make?

A: Common pitfalls include overtrading, not following their trading plan, poor risk management, and letting emotions drive decisions. Be aware of these tendencies and work to avoid them.

For more answers to common questions, visit our expanded Prop Trading FAQs.

Final Thoughts

Becoming a prop trader can be an exciting and potentially rewarding career path for those with a passion for financial markets. It offers the opportunity to trade with significant capital and keep a large portion of your profits. However, it’s not for everyone. It requires dedication, discipline, and a willingness to constantly learn and adapt.

If you’re considering this path, start by educating yourself about trading and practicing with a demo account. When you feel ready, look into prop trading firms like ThinkCapital to start your journey. Remember, success in trading isn’t guaranteed, but with hard work and the right approach, you can give yourself the best chance of becoming a successful prop trader.

Remember, becoming a successful prop trader is a journey that requires continuous learning and adaptation. Stay curious, remain disciplined, and always prioritize risk management. With dedication and the right approach, you can navigate the challenging but potentially rewarding world of proprietary trading.

Ready to start your prop trading journey? Sign up for ThinkCapital’s Trading Challenge today and take the first step towards becoming a funded trader!

It’s important to note that we do not offer real live funded accounts, and all trading is simulated. This approach allows you to gain valuable experience, test your strategies and earn profits based on your performance without the risk of real capital loss.